|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Underwater Mortgage Refinance Non FHA OptionsRefinancing an underwater mortgage can be a challenging but rewarding process. When homeowners owe more on their mortgage than their home's current value, exploring non-FHA refinancing options can be a viable solution. What is an Underwater Mortgage?An underwater mortgage occurs when the outstanding balance on a mortgage loan exceeds the market value of the property. This situation can arise due to various factors, such as declining real estate markets or economic downturns. Implications of an Underwater Mortgage

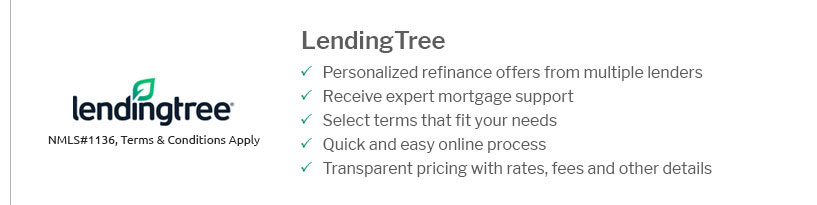

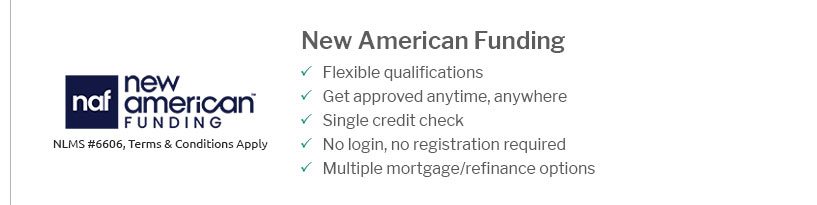

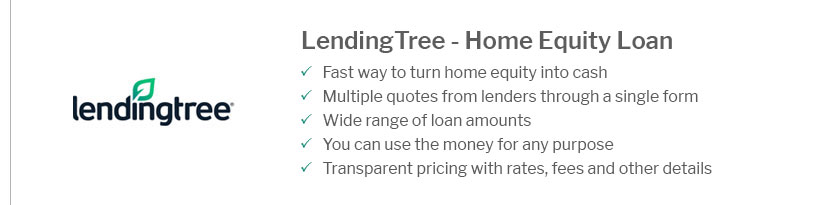

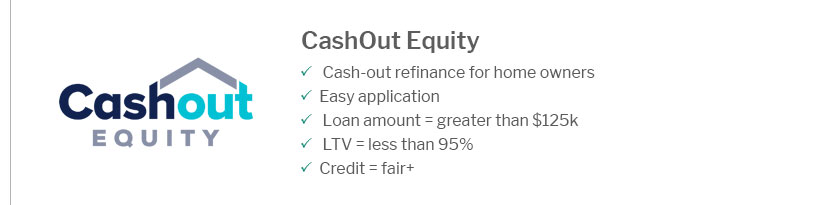

Exploring Non-FHA Refinance OptionsWhile FHA loans are a common choice for refinancing, there are non-FHA options available that can provide flexibility and tailored solutions. Conventional Loan RefinancingConventional loans can be a practical choice for those seeking to refinance without government-backed support. These loans often offer competitive interest rates and terms. HARP ProgramThe Home Affordable Refinance Program (HARP) was designed to assist homeowners with refinancing their mortgages even if they owe more than the home is worth. Although HARP expired in 2018, it paved the way for similar programs. For a detailed comparison of refinancing options, visit refinance and home equity loan to explore various loan products that might suit your needs. Steps to Refinancing an Underwater Mortgage

Successful refinancing can reduce monthly payments and improve financial stability. Potential ChallengesRefinancing an underwater mortgage is not without obstacles. Homeowners may face stringent credit requirements or appraisals that affect the refinancing process. To learn more about managing refinancing for home improvements, consider exploring refinance home improvement loan options that offer tailored solutions. FAQ Sectionhttps://www.americanfinancing.net/refi/refinance-mortgage-with-no-equity

Underwater mortgage? Try the Home Affordable Refinance Program (HARP). HARP was designed for people whose home equity was negatively impacted by the market ... https://www.reddit.com/r/RealEstate/comments/zbhvis/is_being_underwater_on_your_mortgage_actually_bad/

The cost of buying and selling would not make it worth it, even if the house is not underwater. ... The reason you can't refinance an underwater ... https://www.quickenloans.com/learn/underwater-mortgage-options

VA loan borrowers who are underwater may be able to get some relief with a VA Streamline refinance, also known as an Interest Rate Reduction ...

|

|---|